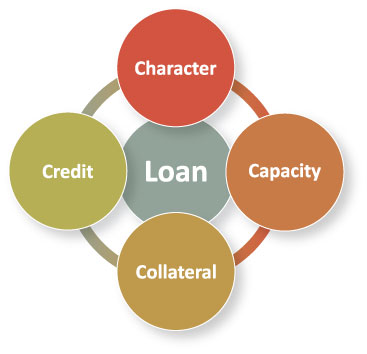

A well-made table has four solid legs, and a well-made borrower is aware of the four C’s of borrowing: character, capacity, collateral and credit. These are the four legs you bring to the table for borrowing. What does each of these legs mean and how does each one keep your table up?

Character

Character is your work and income history. Every borrower needs to show the ability to repay the loan. Have you been regularly employed for at least two years? Banks wants to see that you have a regular income so you can make your loan payments. If you are a job hopper or your income is sporadic because your line of work is seasonal, you may be viewed as a risk. While child support and alimony can be viewed as income, it must be verified and continued for at least three years. If you’re self-employed and own your business, banks want to calculate the average of your monthly net income over two years. Payments of income such as commissions, bonuses and overtime also need to be averaged over two years. By averaging everything over those 24 months, banks can get a better gauge of your ability to repay that loan.

Capacity

Capacity is what you can afford. Are you already leveraged to the hilt? The rule of thumb is that your housing costs (mortgage, taxes, insurance and HOA) should be no more than 38 percent of your monthly income. But after adding in the rest of what you owe, your total ratio of debt to income (DTI) should be no more than 43 percent of your monthly income. If your DTI ratio is higher, your debt load is too heavy and the banks fear you can’t carry that weight, but may make exceptions depending on the overall scenario.

Collateral

Collateral is the house. It is what the lender uses to make sure that if you don’t pay back the money loaned to you, there is something there to help the lender get the money back. This is done through a process called foreclosure, in which you give the home back to the lender in exchange for the balance you owe on the home (not a good idea and will negatively affect your credit). That is the reason most lenders require money down and if you do not put 20 percent down your lender will likely require mortgage insurance. This insurance protects the lender and not the borrower. Banks want you to have enough for a down payment and closing costs. If the bank covers those costs, it usually will be in exchange for a higher interest rate.

Credit

Credit is your payment history, and is undoubtedly the most important C. Banks know that if you regularly paid your debts in the past, you most likely will continue to pay your debts. To establish credit, you should have at least two years of debt payments and four accounts reporting your credit. How is your credit scored (analyzed)? The higher your score, the better your credit is, and the easier it is to get a loan and a favorable interest rate. Did you make any late payments in the past two years? Do you have any judgment, liens, bankruptcies or loan modifications? Any of those negative actions will bring down your credit score. The lower your credit score, the less likely you will qualify.