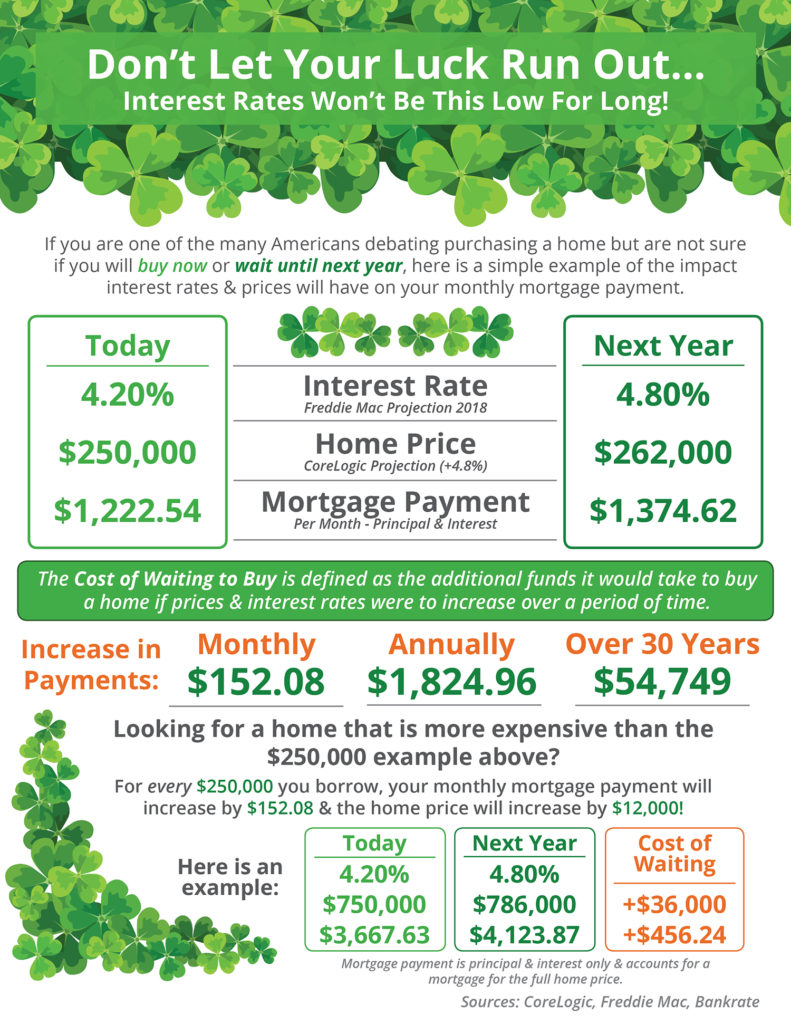

Whether you are a renter who is searching for your dream home or a homeowner who feels like your only option is to renovate, you have at least one thing in common: feeling stuck in place.

According to data from the National Association of Realtors’ Profile of Home Buyers & Sellers, the average amount of time that a family stays in their home remained at 10 years in 2017. This mark ties the highest marks set in 2014 and 2016. Back in 1985, when data was first collected on this subject, homeowners stayed in their homes for an average of only 5 years.

There are many reasons why homeowners have decided to stay and not to sell. A recent Wall Street Journal article had this to say,

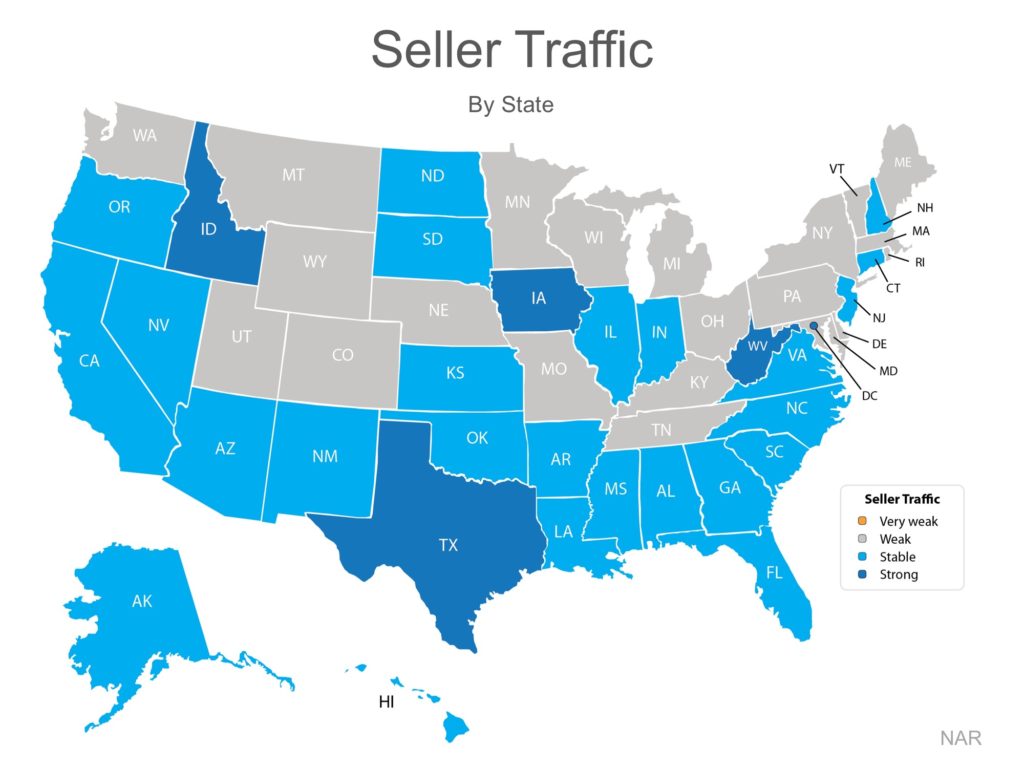

“Americans aren’t moving in part because inventory levels have fallen near multidecade lows and home prices have risen to records. Many homeowners are choosing to stay and renovate, in turn making it more difficult for renters to enter the market.”

Sam Khater, Deputy Chief Economist for CoreLogic, equated the lack of inventory to “not having enough oil in your car and your gears slowly [coming] to a grind.”

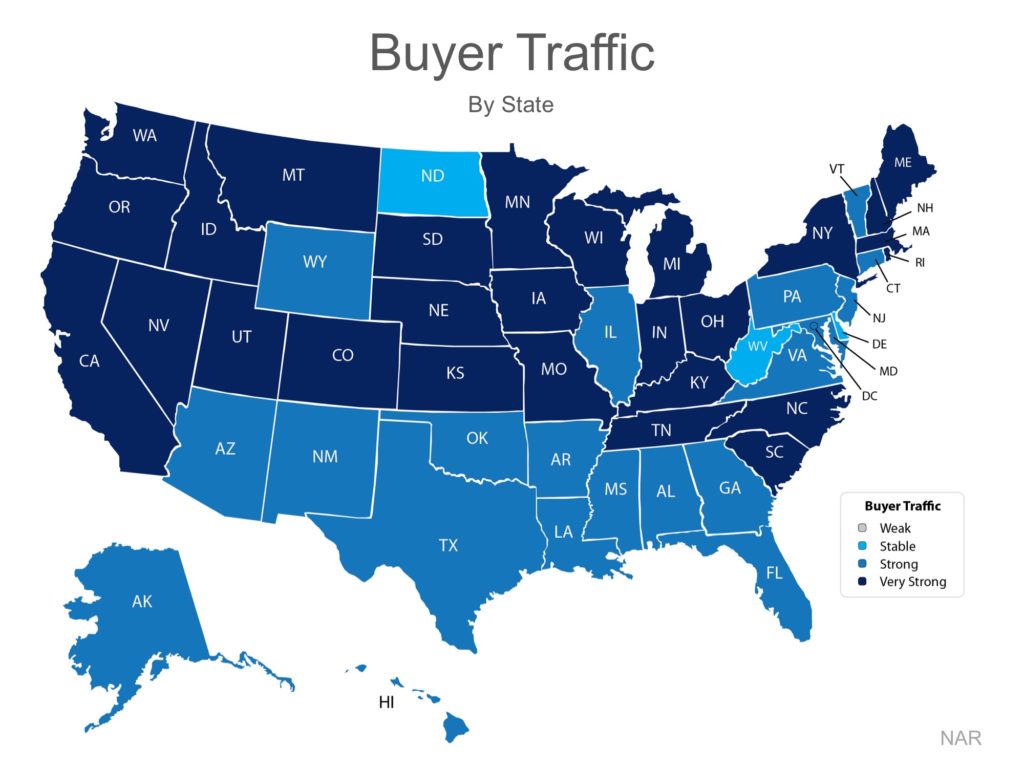

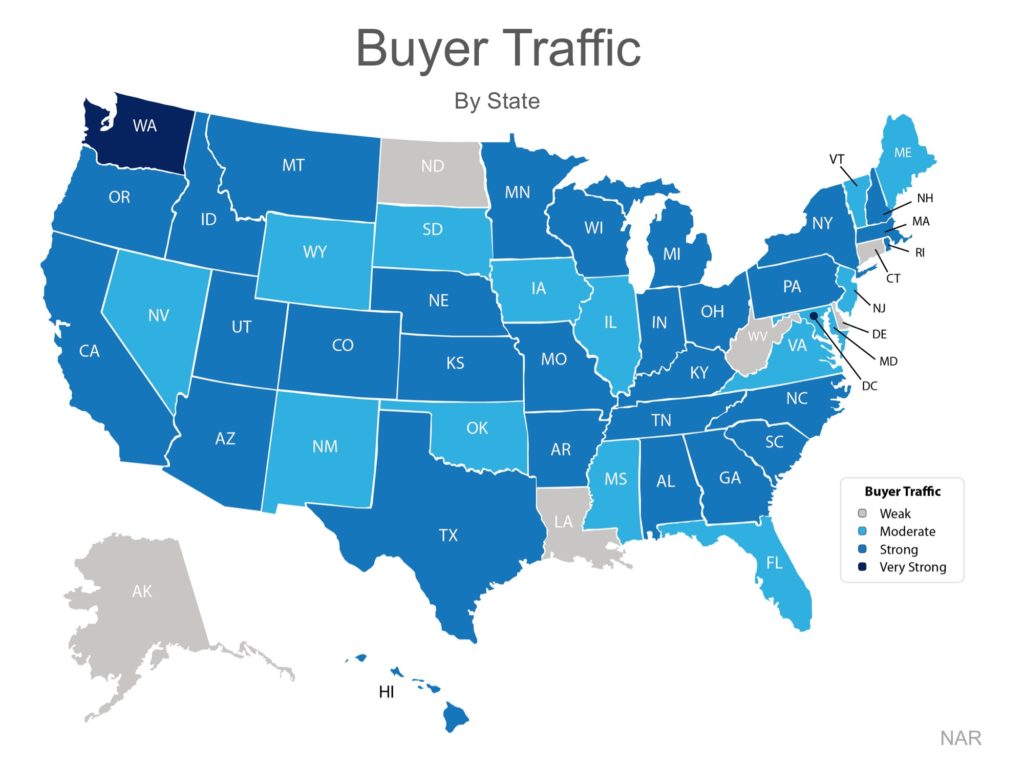

Historically, a normal market (in which prices increase at the rate of inflation) requires a 6-7 month supply of inventory. There hasn’t been that much supply since August of 2012! Over the course of the last 12 months, inventory has hovered between a 3.5 to 4.4-month supply, meaning that prices have increased and buyers are still out in force!

Challenges in the new-home construction market have “helped create a bottleneck in the market in which owners of starter homes aren’t trading up to newly built homes, which tend to be pricier, in turn creating a squeeze for millennial renters looking to get into the market.”

“Economists said baby boomers also aren’t in a hurry to trade in the dream homes they moved into in middle age for condominiums or senior living communities because many are staying healthy longer or want to remain near their children.”

So, what can you do if you feel stuck & want to move on?

Don’t give up! If you are looking to move-up to an existing luxury home, there are deals to be had in the higher-priced markets. Demand is strong in the starter and trade-up home markets which means that your house will sell quickly. Let’s work together to build in contingencies that allow you more time to find your dream home; the right buyer will wait.