As we are about to bring in the New Year, families across the country will be deciding if this is the year that they will sell their current house and move into their dream home. Many will decide that it is smarter to wait until the spring “buyer’s market” to list their house. In the past, that might have made sense. However, this winter is not like recent years.

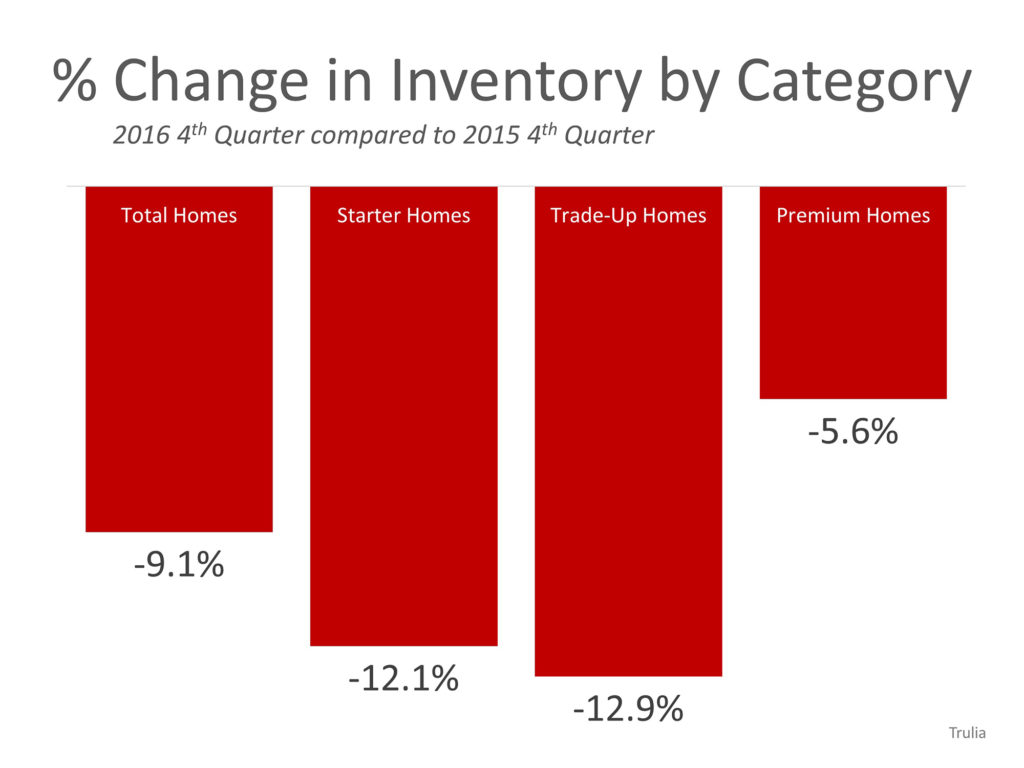

The recent jump in mortgage rates has forced buyers off the fence and into the market, resulting in incredibly strong demand RIGHT NOW!! At the same time, inventory levels of homes for sale have dropped dramatically as compared to this time last year.

Chart above showing the decrease in inventory levels by category.

Demand for your home is very strong right now while your competition (other homes for sale) is at a historically low level. If you are thinking of selling in 2017, now may be the time.

#carlspiteriteam #benchmarkmortgagecarlspiteri #CAlender #mortgage #BenchmarkMortgageCarlSpiteri #weloveourclients #SDlender #soCalLender #homeloans #sdhomes #lendersandiego #homemortgage #loans #sandiegohomes #smarthomebuyerworkshop #prepp #sold #loveourclients #WantToMove #BuyMyHouse #RealEstate #NewHome #HouseHunting #HomesForSale #Investment #Mortgage #Realtor